WTF are NFTs?

By

3 years ago

Step into the world of non-fungible tokens

Your friends have them; your favourite brands want you to buy them; your news feed is full of them, but do you need non-fungible tokens in your life? Robert Jackman guides you through the latest digital craze.

Why is Everybody Talking about NFTs?

WTF are NFTs?

When the elders at Collins English Dictionary made ‘NFT’ their word of 2021, they must have known they were on to something. Unlike other recent winners – which included the predictably ubiquitous ‘lockdown’ and, before that, ‘Brexit’ – here was a word that some of us had probably had cause to look up at some point in the year. Maybe more than once.

So what exactly is an NFT? Standing for ‘non-fungible token’, it’s actually a reasonably simple concept – provided, that is, you have some familiarity with blockchain, the vast computerised networks which underpin, among other things, cryptocurrencies like bitcoin. But while bitcoin and its successors used blockchain to create digital bank vaults, NFTs use them as a digital registry: creating a verifiable and transparent link between an owner and a specific item.

Think of NFTs, then, as working like the land registry – except that, rather than being overseen by human administrators, records are kept in check by a network of computers. The problem with this definition, though, is that – while largely exhaustive – it does little to explain how NFTs have gone from nerdish obscurity to a $20bnstrong market straddling the worlds of art and luxury goods. And seemingly overnight too.

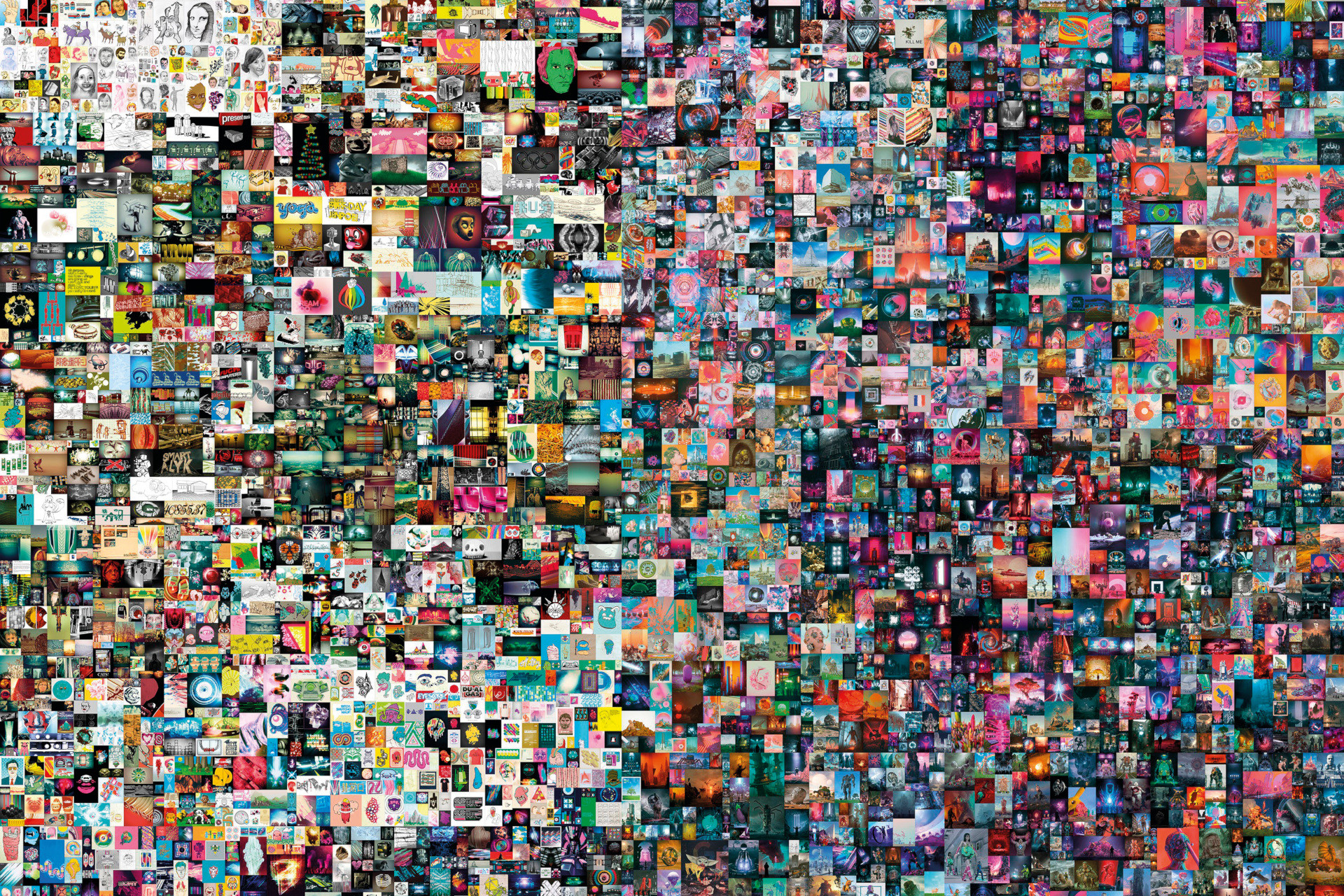

The First 5000 Days by Beeple sold at Christie’s for $69m

The high point in NFT mania came last summer, when a piece of digital art – or at least the digital ‘ownership’ of it – sold for $69m at Christie’s. The image – titled The First 5000 Days – was the creation of Michael Winkelmann, a 40-year-old graphic designer who works under the name Beeple. Winkelmann had been producing CGI creations since 2007, building up a cult following for his cartoonishly grotesque depictions of America’s political and cultural elites. Now he was in the same price bracket as Picasso.

What did the artist have to say about his work going for an eight figure sum? His reaction on social media – a two-word tweet containing the word ‘holy’ and a certain expletive – suggests he was just as shocked as the rest of us. To the untrained eye (less of an impediment than elsewhere in the NFT market), Beeple’s work hardly screams high art – resembling, as it does, the kind of heavy-handed satire you might find on a student poster.

So why did it fetch such an astounding price? The truth is that The First 5000 Days had the good fortune to become the subject of an intense bidding war between three prominent cryptocurrency investors (or ‘whales’ as they’re known). That the crypto market had just been on yet another serious bull run – with NFT-linked Ethereum quadrupling in value between January and May – had likely left enthusiasts feeling flush. Giddy enough, evidently, to consider spending $69m on a JPEG.

Arguably, though, that wasn’t even the most baffling purchase in the year of the NFT. In September, an NFT of a single grey pixel – the work of an online artist known only as Pac – fetched $1.36m at Sotheby’s. A work designed purely to troll NFT enthusiasts – by pointing out how anyone can ‘right-click and save’ any image they like – sold for more than $7m.

Damien Hirst with some of the 10,000 pieces in The Currency, which can be bought as physical works or NFTs

From time to time, the art world has sought to get in on the joke. In September, Damien Hirst unveiled The Currency, a deliberately underwhelming range of NFT-inspired dot paintings priced at $2,000 each. Buyers could choose to take either a physical print or an NFT. But there was a catch: whichever format they didn’t choose would be destroyed.

It isn’t just the art market that has got NFT fever. Ever since NFTs went mainstream, luxury goods brands have been busy coming up with their own digital offerings. Back in April 2021, watchmaker Jacob & Co reportedly sold a virtual wristwatch for more than $100,000. Since then, Louis Vuitton, Burberry, Moncler and Balençiaga have all begun dipping their toes into producing ‘luxury’ items to be worn in the ‘metaverse’ – a market that one investment bank predicts could be worth more than $10bn by the end of the decade.

Burberry partnered with Mythical Games to launch an NFT collection for the video game Blankos Block Party

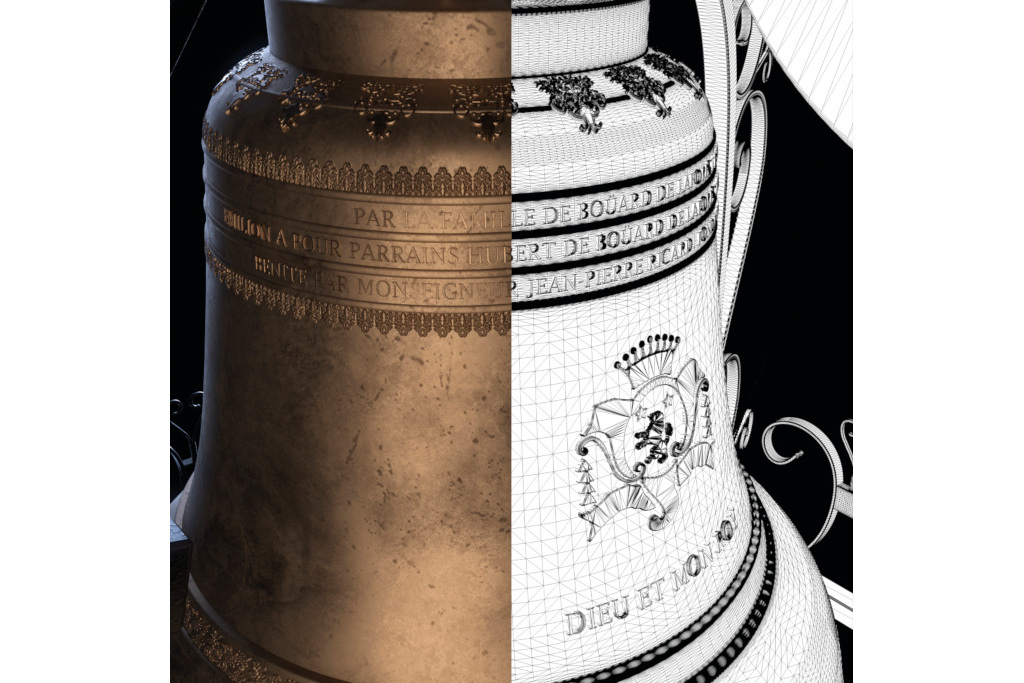

As a rule of thumb, where exclusivity exists, NFTs aren’t far behind. Renowned Bordeaux winemaker Château Angélus issued NFTs alongside the launch of its 2020 issue. The idea was that buyers would not only have proof of ownership of their barrel, but would also be able to resell the collectible digital artwork further down the line.

Are NFTs a good investment? Looking at online marketplaces like OpenSea, it certainly isn’t hard to find NFTs selling for impressive multiples of their last purchase price. But for all the comparisons to the crypto boom, the NFT marketplace is very different. While bitcoin has always allowed investors to buy as much or as little as they like, NFTs are like discreet luxury goods: you either buy one outright or you don’t. Just as you can’t invest £1,000 in a fraction of a Patek Philippe, it isn’t possible to purchase ‘shares’ in NFTs.

NFT issued by Bordeaux winemaker Château Angélus

If you want to sell your NFT, you need to find a buyer. Which means paying to list it on an auction site. Even on the busiest exchanges, it’s common for NFTs to spend months on end waiting for a single bid. Meanwhile, the fact that anyone can make an NFT means that markets quickly become flooded with copycat projects. Artists are already raising the alarm about fakes.

To a dedicated tribe of true blockchain believers, though, all of this is a distraction. These would-be tech prophets insist that NFTs aren’t a tool for speculative finance, but instead part of a fundamental reimagining of the internet. NFTs, they say, will be one of the main building blocks for ‘web 3.0’: a futuristic vision of a ‘decentralised’ internet in which we interact not through corporate social media platforms but instead through self-policing digital collectives.

In this new internet, NFTs will serve as a digital keycard: providing proof that we are who we claim to be. Access to a certain digital space – for example, a virtual hang-out for art collectors – will be dependent on having the correct NFT. As users interact with that space, they may receive more NFTs, giving them a larger stake in the community. The problem with this theory is that, in as much as NFTs are even creating communities, they are functioning less like digital kibbutzim and more like ultra-exclusive clubs that only amplify real world inequalities.

Jacob & Co’s virtual wristwatch

Look at CryptoPunks: a range of 10,000 similarly styled digital avatars launched in 2017 to provide digital pin badges for in-the-know crypto enthusiasts. Five years on and these Minecraft-like doodles trade hands for millions of dollars. A similar collection of ‘Guess Who’ style JPEGs, the ironically-named Bored Ape Yacht Club, has recently become the latest status craze amongst Hollywood celebrities. Paris Hilton is one of the most recent converts: paying more than $300,000 for a digital image of an ape in shades and a leather cap to put on her social media profiles.

Will it all come crashing down? Quite possibly. Listen to the NFT critics (there are plenty) and you’ll find wellrehearsed criticisms that the industry is the preserve of charlatans and chancers. The evangelical posturing of recent buyers – including Hilton bestowing free NFTs on an entire studio audience – has done little to quell criticism that the whole thing is mindless hype. There’s one thing you can’t deny about the NFT crowd though: they’re not afraid to put their money where their mouths are. And then some.

Featured image: The First 5000 Days by Beeple

READ MORE

Immersive Exhibitions To Book Now / Where to Spot Street Art in London